In the 14 years since its inception, WeWork has enjoyed a meteoric rise to ‘$47 billion unicorn’, followed by a crash back down to earth with a failed IPO in 2019. Subsequent to an 80% plummet in value, WeWork eventually went public in October 2021 at a more terrestrial $9B, and has reported billions in losses. Despite the pandemic and associated office occupancy slump, occupancy and costs are finally moving in the right direction, profitability has never been closer. So, what must WeWork do to breakeven?

WeWork losses moving in the right direction

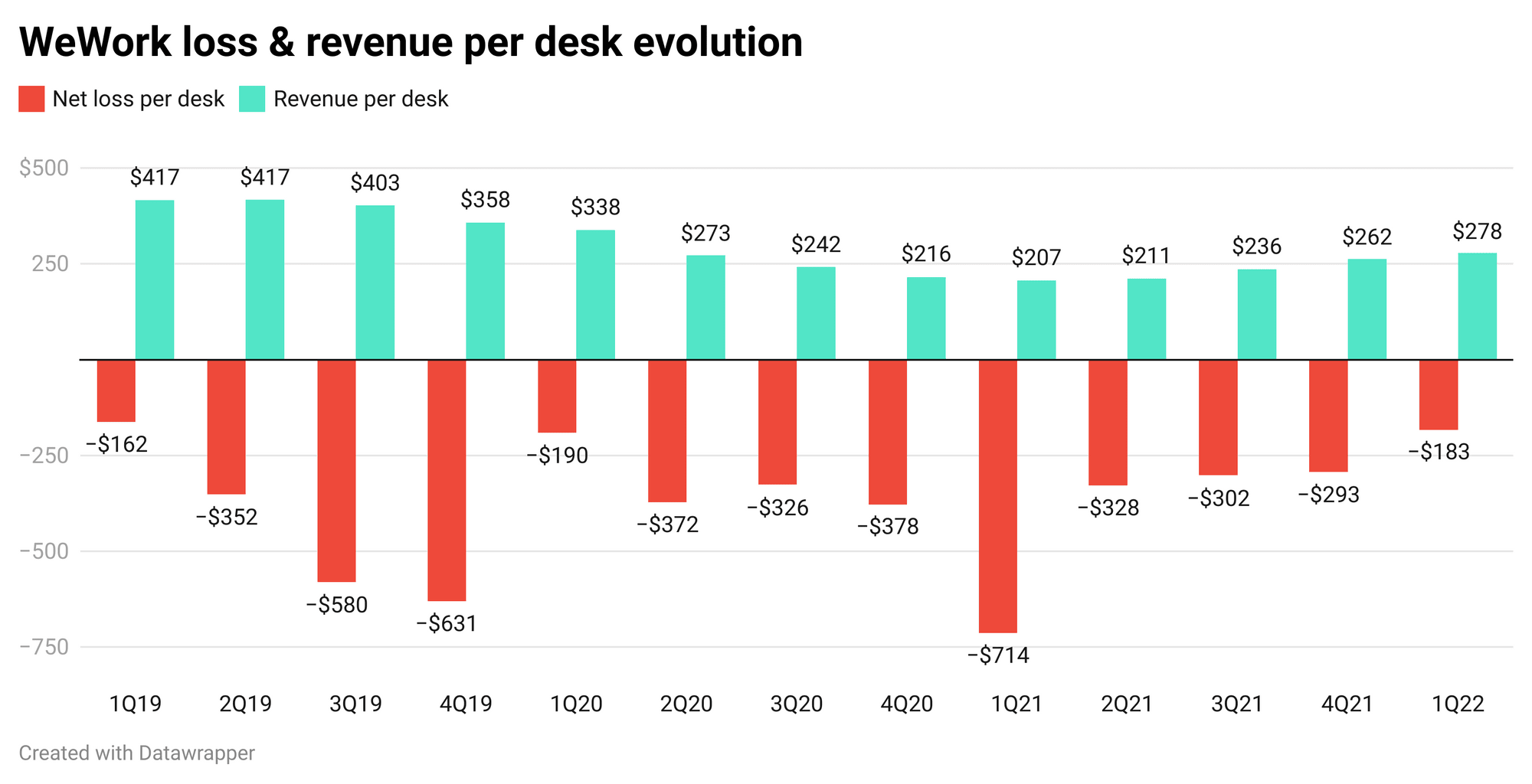

Whilst losses are typically an accepted reality for start-ups, 14 years on WeWork is still spending more than it’s taking. The company racked up losses of $803 million in the fourth quarter of 2021. However, the coworking concept, by and large raised by the brand, has enthralled the public and investors alike, and losses are finally getting smaller and the revenue taller… WeWork are closing in on breakeven - but what will it take to get there?

By analyzing the quarterly reports, along with our understanding of the industry via flex data, we have put together a picture of where the company has climbed to, and how it can hope to reach the summit.

Where are WeWork now?

As of Q1 2022, revenue stood at $765M, and net loss at $504M. Managing 916,000 desks and now reaching 622,880 desks occupied (68% occupancy), this means a revenue per desk (RevPAD), per month of $278 and a loss per desk per month of -$183 for WeWork. It also allows us to infer a price per desk of $409.

For context, Q1 of 2019 is the gold standard for WeWork - they hit 80% occupancy at $417 revenue per desk. This was ahead of their IPO attempt, and of course the pandemic.

There are 3 major headlines from the latest quarterly report:

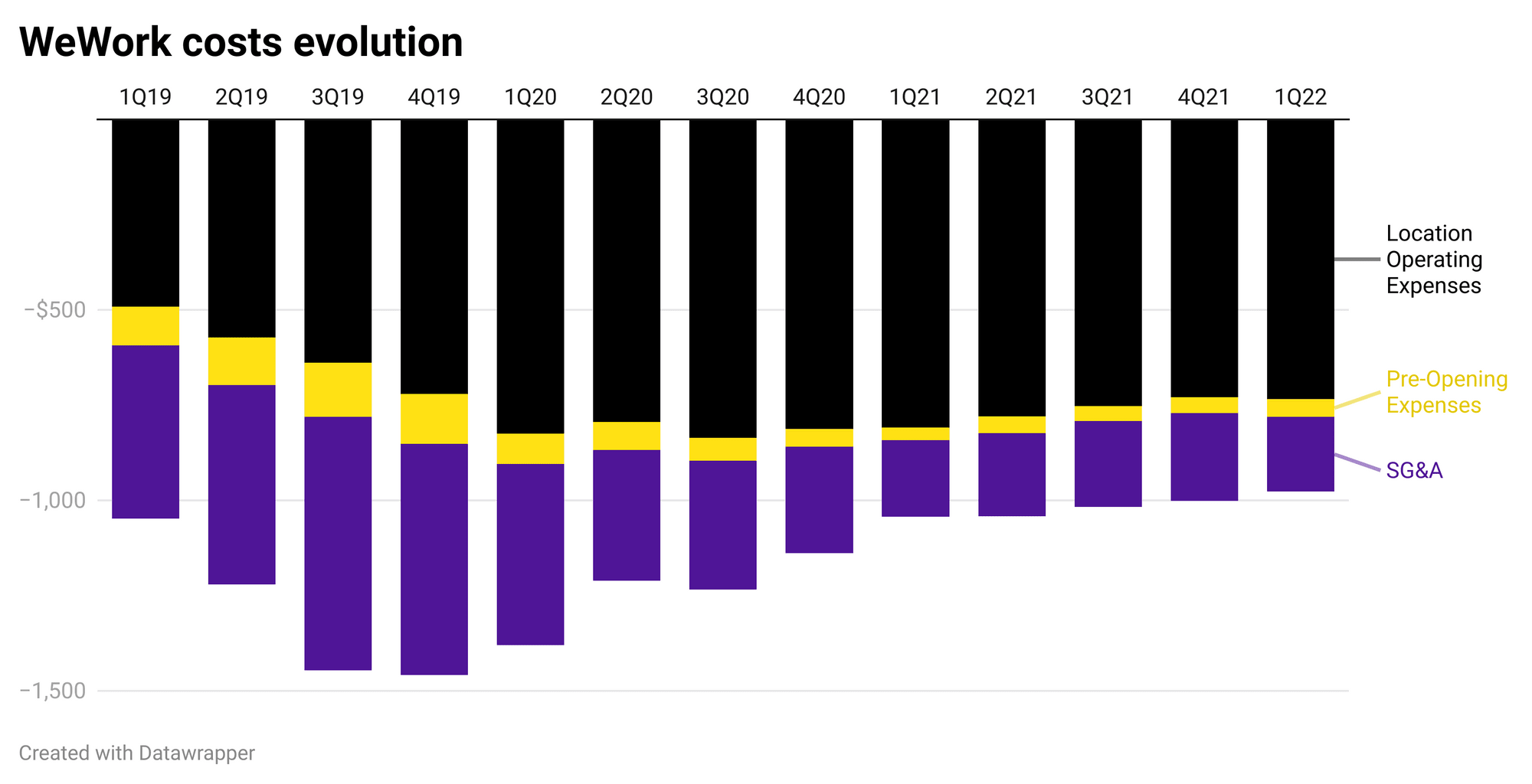

1. WeWork has drastically reduced costs

While 'rent' costs (location operating expenses) are largely out of WeWork hands if they want to avoid inventory falling, 'controllable' costs have really turned around.

Pre-opening costs have reduced significantly (53%). Sales, general and administrative costs are also down - 57% comparedwith 1Q2019. Now, they represent just 20% of total costs as apposed to 43% in 1Q2019.

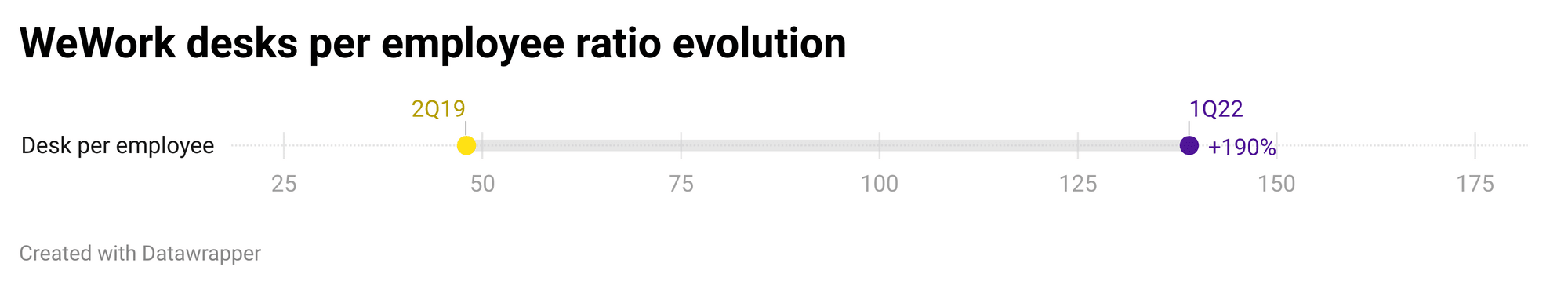

These cuts become more tangible when we look at the data surrounding staffing. Desks per employee was just 48 in Q12019, where now it is 139 (+190% - below), and the revenue per employee has risen 92% ($115,874 up from $60,480).

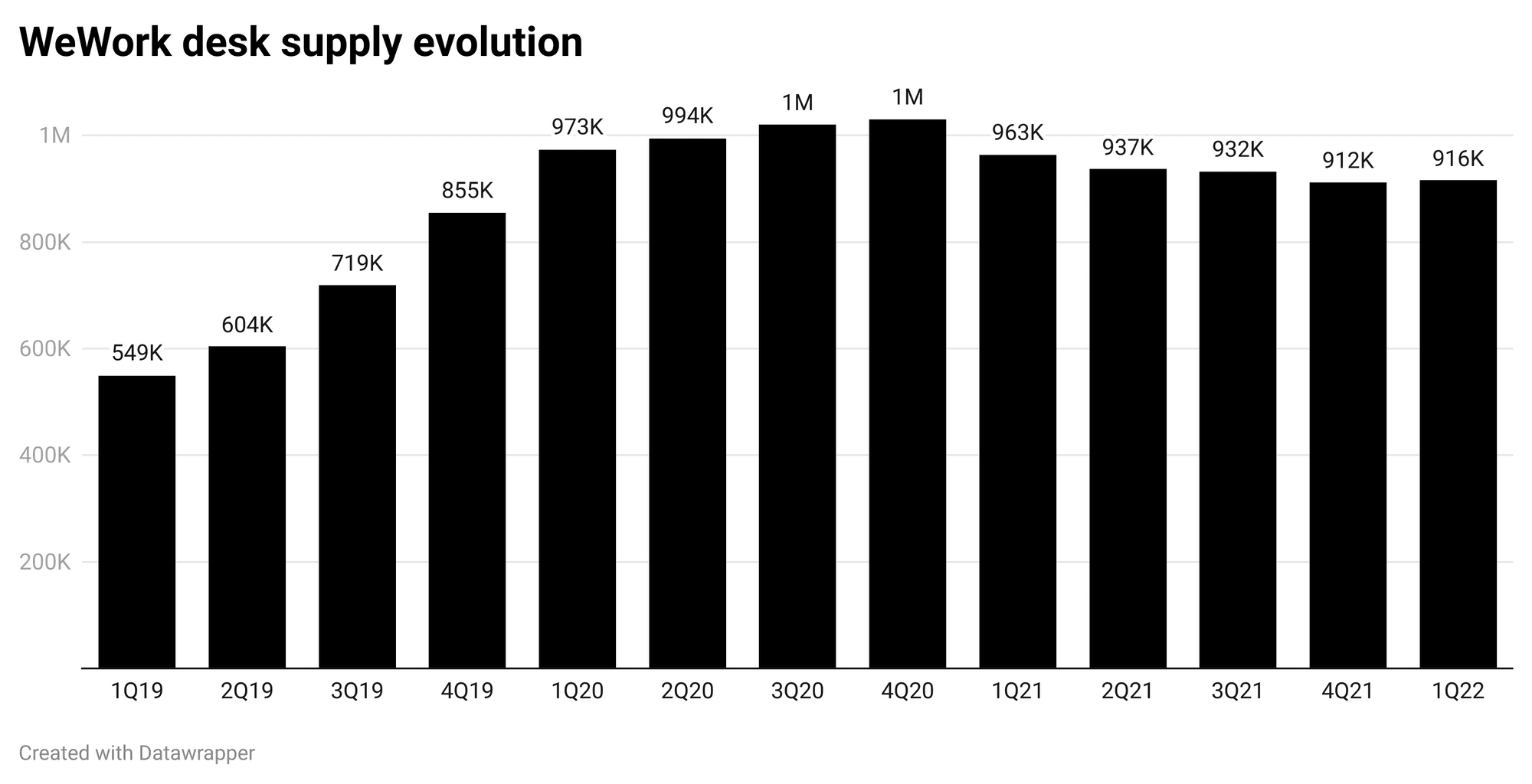

2. WeWork has stabilized desk numbers

Crucially, the company has achieved this cost demolition whilst maintaining inventory.

Supply is has only dropped 6% through the pandemic, and remains 67% higher than the golden 1Q2019.

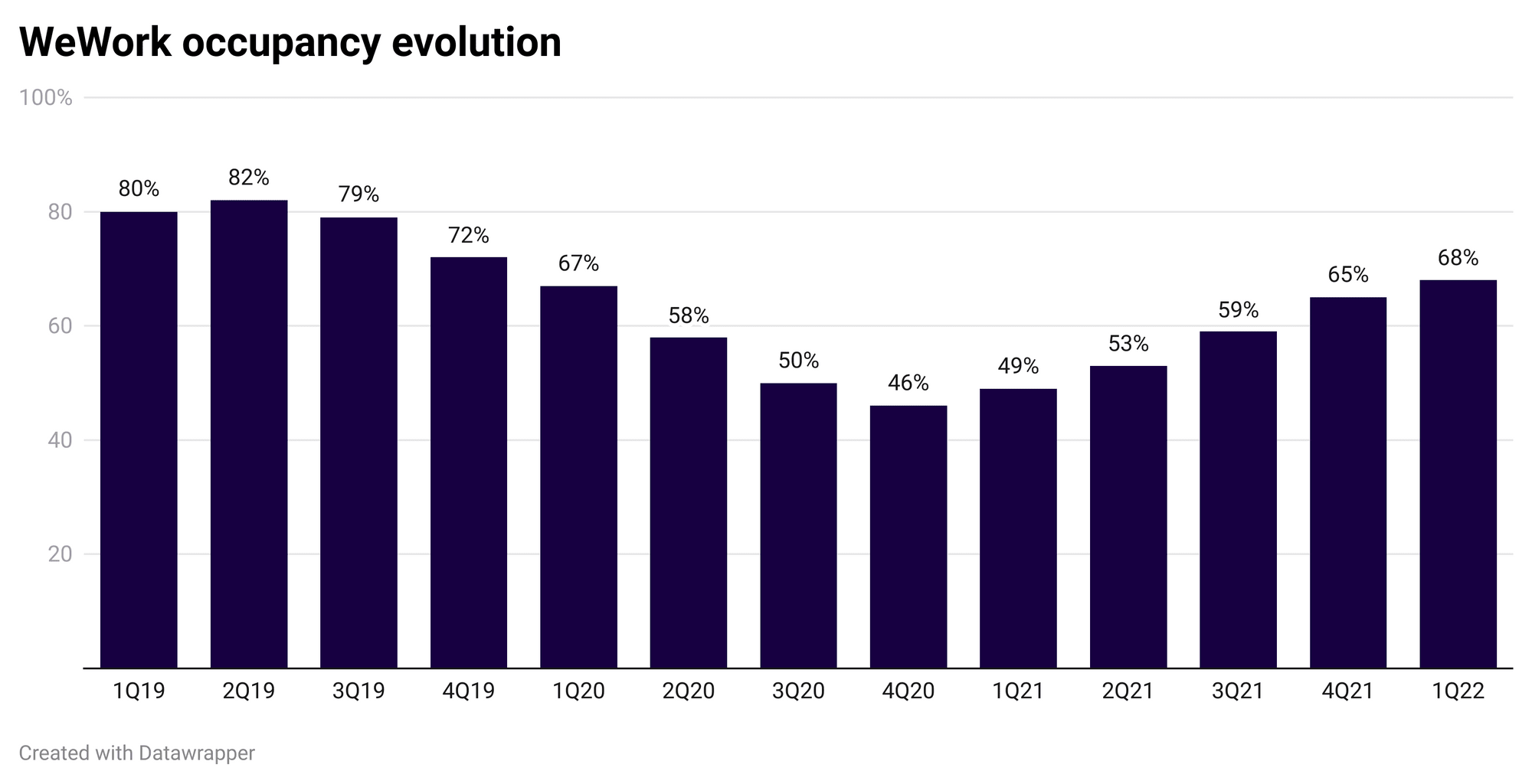

3. Occupancy has increased back to pre-pandemic levels

For the first time since COVID-19, occupancy is back to levels only previously exceeded in 2019 (68%) - see below chart. Critically, there has been a clear growth trend since 4Q2020.

All of this means that profitability has never been closer:

The chart above illustrates that whilst desk prices have shifted back towards pre-pandemic levels, crucially, cost-cutting has been impactful, contributing to the lowest delta to breakeven yet. So, what next on the path to breakeven?

What must WeWork do to breakeven?

WeWork has 3 options. It can cut costs, raise desk prices, and/or increase occupancy. We have seen from the above cost analysis that 'controllable' cost aspects have been slashed considerably, so, working on the assumption that these costs are set to remain consistent, we have asked the question, what must WeWork do to breakeven?

With its current cost structure, WeWork must adapt its price per desk, per month or increase its occupancy - or both. The below chart shows our simulation of the price vs occupancy line required to breakeven.

With current occupancy level (68%), desk rate would have to reach $660 per month to breakeven. Meanwhile, with current rates remaining stable, WeWork will remain at a loss; even with 100% occupancy, the minimum desk rate required to breakeven would be $462.

Ultimately, if WeWork recovers to peak (1Q19) occupancy levels (80%), the monthly price per desk would need to reach $561 to breakeven. This equates to a 41% increase compared with today’s revenue per desk, and an 8% increase over 1Q19 revenue per desk.

The bottom line: what must WeWork do to breakeven?

The numbers don’t lie, in order to pull WeWork from great concept, to great business, and breakeven (let alone become profitable) one of 3 things must happen:

- Monthly desk rate would have to increase by 61% with occupancy remaining stable

- With occupancy returning to pre-covid peak (+18%), monthly desk rate would need to rise by 37%

- A further restructuring of costs

A Q2 2022 update

Per WeWork's 2Q22 quarterly results, we have updated our analysis to monitor progress.

We can see that both occupancy and desk rate are up on 1Q22. However, the crucial shift here is the breakeven line. This line is defined by the relationship between costs and revenue, and it has shifted per the latest financial results - the wrong way. Where based off the Q1 line, WeWork would now be closer to breakeven, with the new Q2 line, that elusive breakeven point is actually further from reach.

As a result, at current cost levels, WeWork would now have to charge 732 USD per desk month - a 78% increase on its current 411 USD - to breakeven. Or, will costs pull that breakeven line in the right direction next quarter?

Learn more from our data

Understand how our data powers flex operators and landlords by visiting our website:

Explore CoworkIntel