CoworkIntel are the leading force in flexible workspace intelligence. We have analyzed coworking spaces the world over to bring you a 2021 map of the world, bringing insight into supply, pricing, brands & evolution by world region.

Understanding industry climate and trends gives critical input for operator, landlord, investor & broker strategy.

View the full report here: https://bit.ly/coworking-world-map-2021

Coworking Pricing

Pricing in flexible workspaces is a balancing act with occupancy to ensure maximal revenue. That is where data can help! Let's see where pricing is at globally and how it's progressing.

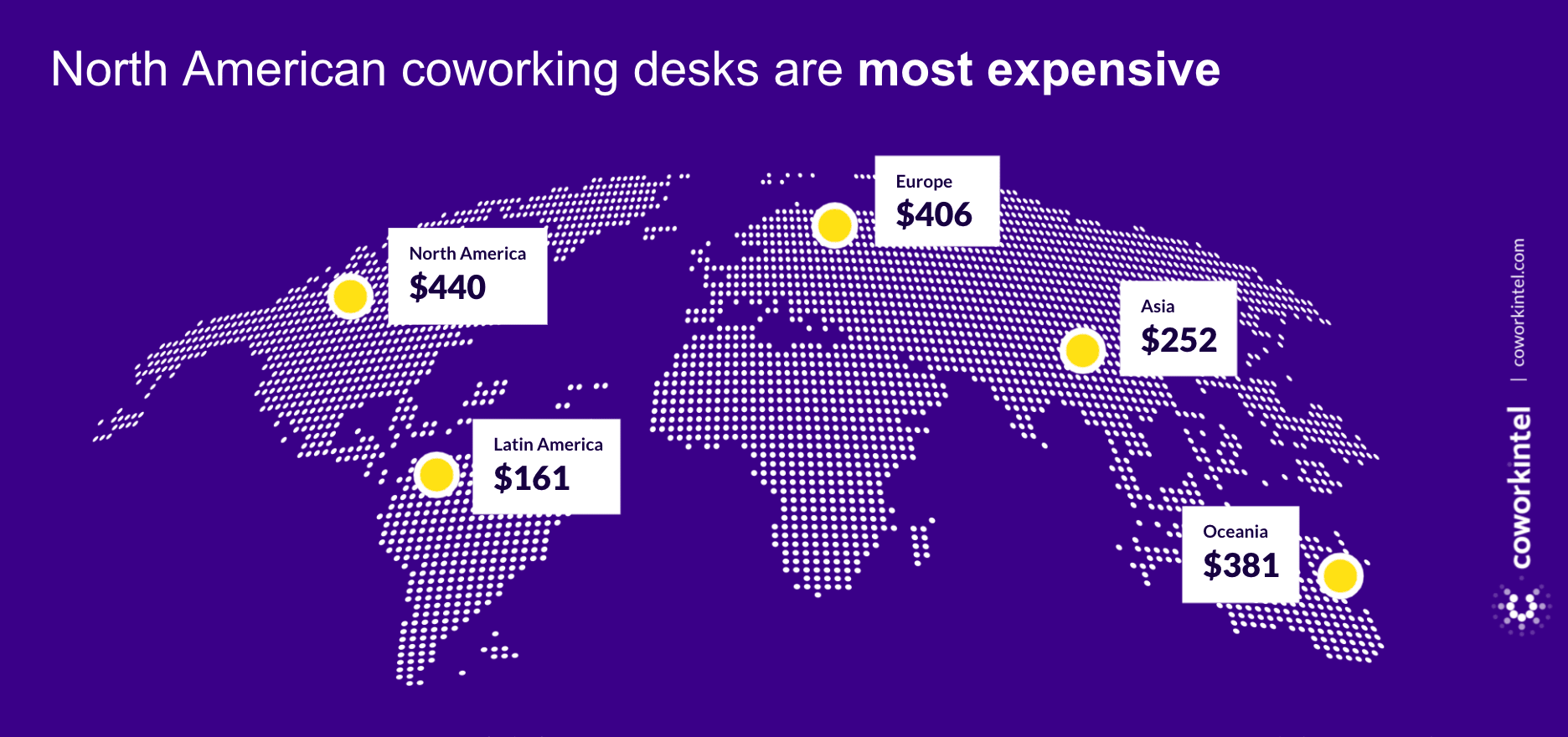

Average coworking desk rate

Visibility over pricing amongst coworking spaces in your market ensures that you can competitively align yourself with those in your competitive set.

Average monthly coworking desk rate (USD) in August 2021 by world region in the image above is the first insight of the full report. It shows North America as having the highest monthly desk rate, with Europe & Oceania not far behind. It is worth noting that in addition to cost of living, proportions of desk types may contribute to their advantage over Asia & Latin America. For example, a higher proportion of private office desks in North American spaces likely drags the average up.

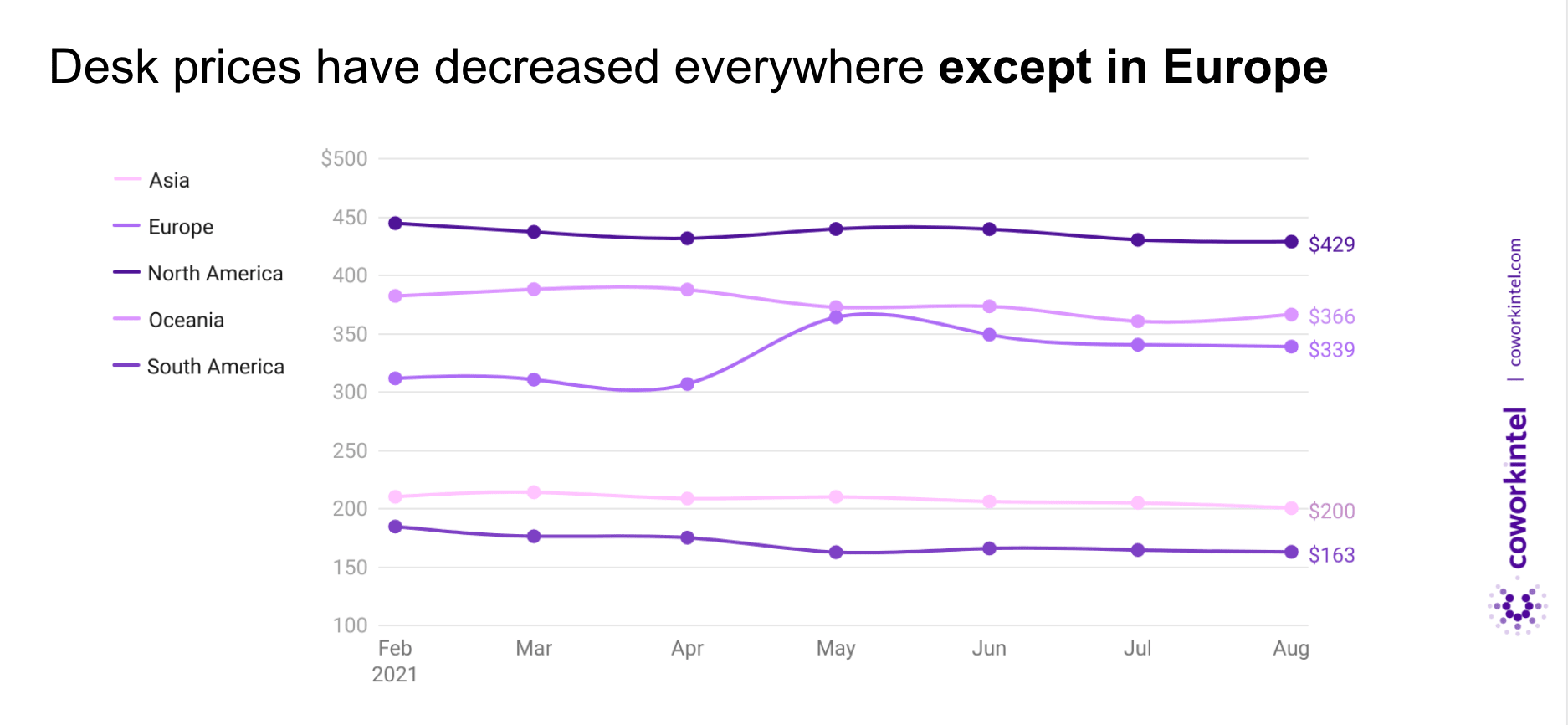

Coworking pricing evolution

Tracking evolution allows you to make proactive changes to stay ahead of the demand curve. The following chart looks at this evolution across key world regions:

We see monthly desk rate falling over the past 6 months across all areas except Europe, where prices have actually increased 9%.

Check the full report to view global pricing evolution and more analysis.

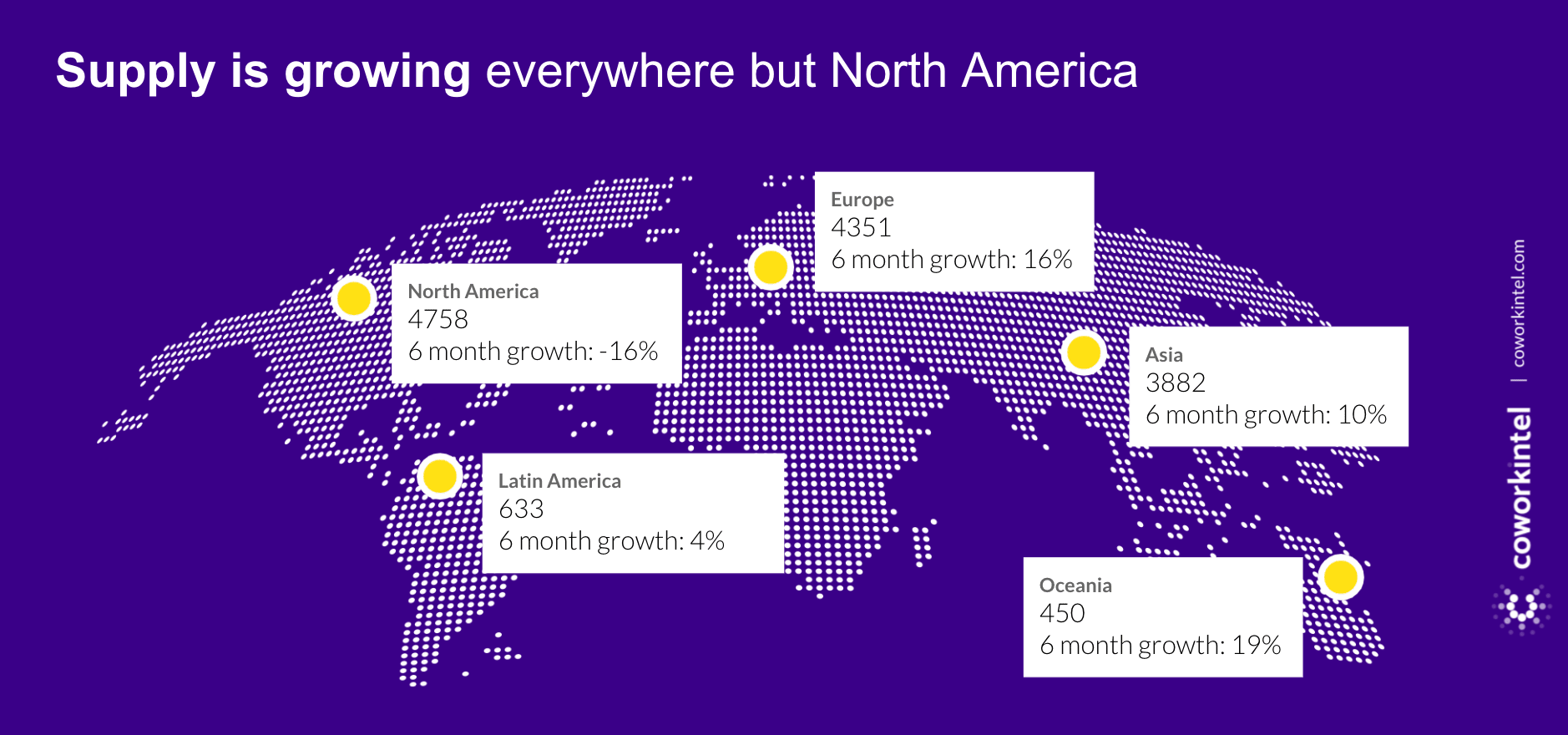

Coworking Supply

Count of coworking spaces in August 2021 by world region and growth since February 2021 shows that North America is the only world region to see a decrease in coworking spaces. Oceania & Europe are on top with 19 and 16% more spaces than 6 months ago respectively. Growth in Asia and Latin America are also strong.

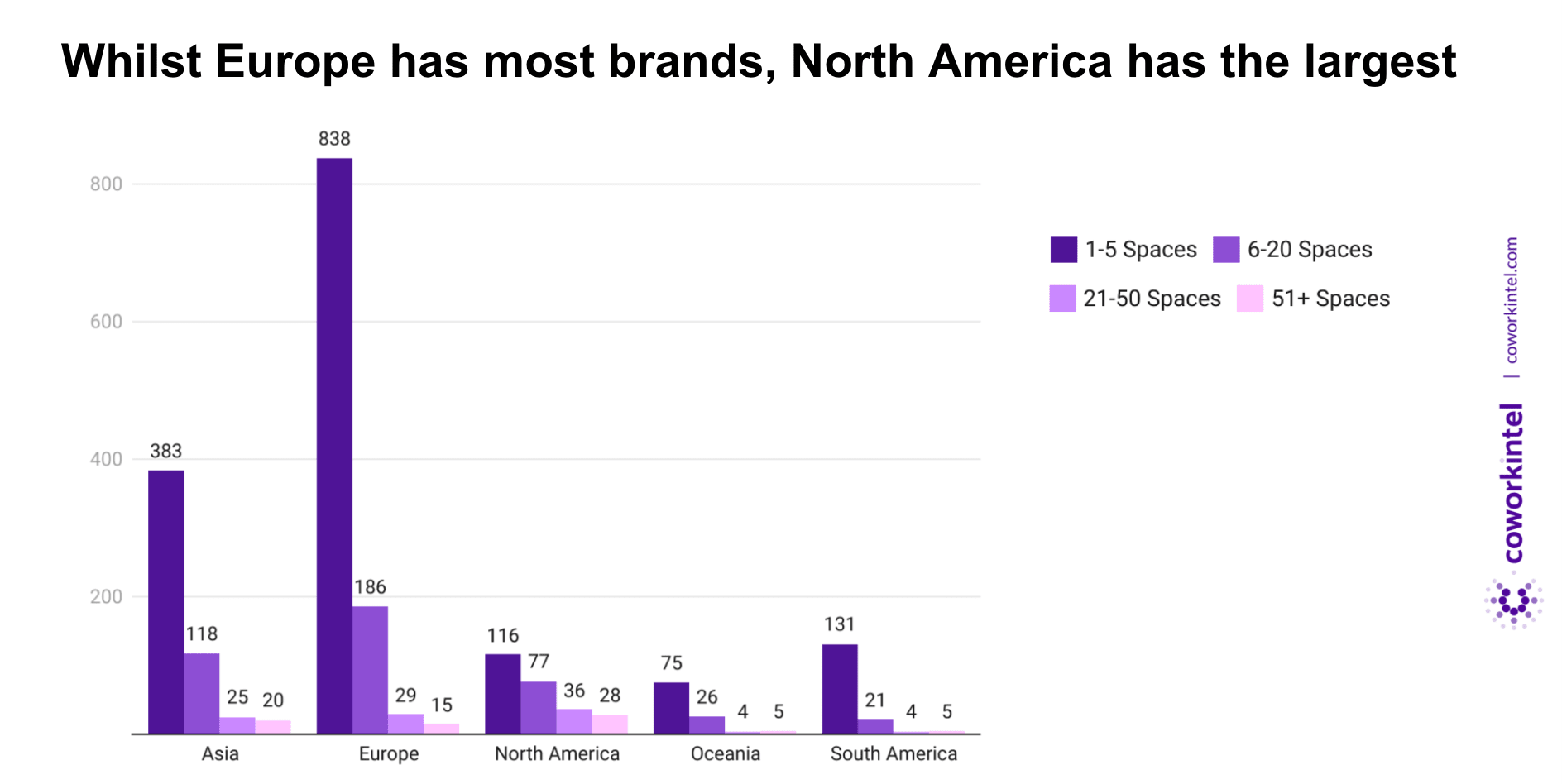

Coworking Brands

An interesting development to track is the number and size of brands, and how these are evolving.

Likely due to the sheer number of ‘developed’ nations, Europe towers above other world regions in terms of overall numbers of brands; which perhaps also explains why the vast majority are small brands with 5 spaces or fewer.

North America meanwhile boasts the highest number of large coworking brands, with 64 managing 21+ spaces.

Of our other regions, Asia has the second highest amount brands in total and matches Europe for large brands.

Latin America comes in next, perhaps surprisingly eclipsing Oceania.

Coworking Map of the World 2021: Free PDF Report

We will wait to see how this progresses over the coming months - watch this space! In the meantime, check out our free 2021 Coworking Map of the World here.

You can also learn more about our dashboards, and how they can fuel operators, investors & brokers alike to higher revenues, at our website here.